销售网络

集团公司长期致力于市场的开发和专家网络的建设,现拥有专业的临床学术推广团队和OTC团队。近年来集团以义乌总部为载体、杭州的营销行政管理中心为核心,基本实现了销售网络的全国覆盖。真诚希望与各界朋友携手共进、共创辉煌、回报社会。

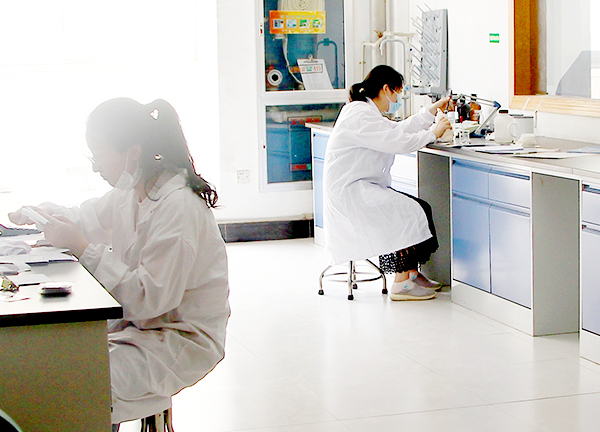

研发团队

公司先后承担科技部火炬计划项目、国家创新基金项目、浙江省火炬计划项目、浙江省生物制药重大专项省经贸委中药现代化专项资金项目,并已顺利通过验收,并与上海大学、浙江大学、中国食品药品检定研究院中科院上海药物研究所、天津药物研究院、国家上海新药安全评价研究中心、中山大学肿瘤防治中心等多个单位建立了良好的协作关系,开展了多项课题的临床前药学、药理、新药作用机理、毒理和安全

性评价及临床研究。

18新利中国控股集团总部

电 话:0579-85125018, 85125028

邮 箱:dadexiaoguan2007@163.com

地 址:中国·义乌经发大道218号

第二行政中心

电话:0571-89921395

邮箱:ddyyhz@126.com

地址:中国·杭州拱墅区绿地中央广场11号楼22层

CopyRight 2015 All Right Reserved 18新利中国 浙ICP备20029881号-1

浙公网安备 33078202001341号

0579-85125018